Franklin Templeton’s Goals Optimization Engine (GOE®) is now on TIFIN Wealth

Now advisors can optimize portfolios to increase the likelihood of achieving client retirement goals with GOE® + TIFIN Wealth.

Introducing Goals Optimization Engine (GOE®) on TIFIN Wealth

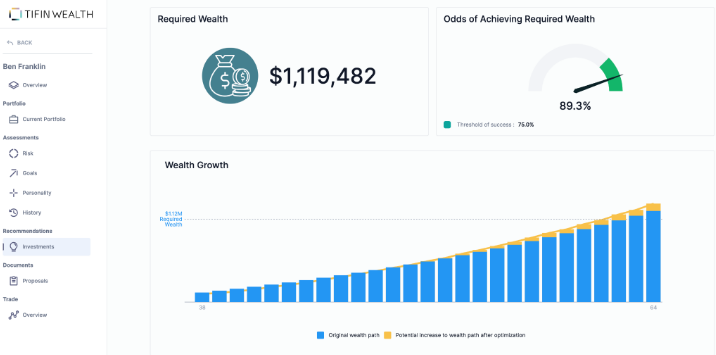

With the Franklin Templeton Goals Optimization Engine, a portfolio can be created for different retirement goals an investor has. GOE® then actively adjusts the asset mix over time, seeking to help increase the probability of successfully reaching each goal.

This shifts the optimization from a risk-centric approach, to making portfolio adjustments that increase the likelihood of achieving a specific goal.

Advisors have the option of choosing risk-based optimization vs. GOE-based optimization on a per client basis.

GOE® also provides additional recommendations to improve the probability of achieving each investor’s goals.

How GOE® Works

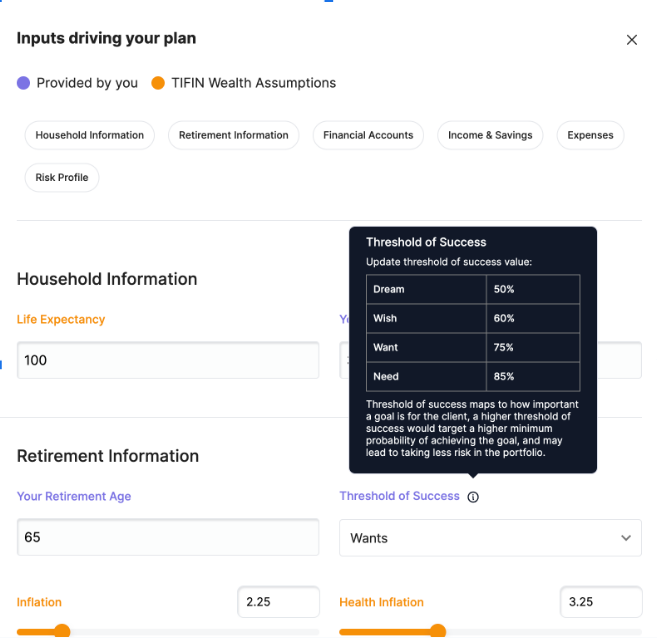

With each client goal, an advisor can set it to one of four tiers:

-

-

Dream (50% likelihood)

-

Wish (60% likelihood)

-

Want (75% likelihood)

-

Need (85% likelihood)

-

The GOE® capability makes allocation adjustments in the portfolio to maximize the chance the investment amount hits the pre-defined likelihood over the set duration for the goal.

This keeps each goal-based retirement portfolio on track.

© 2023 TIFIN Group, LLC.

TIFIN WealthTech, LLC operates under multiple RIA firms and a Broker Dealer. Please see the individual solution pages at tifinwealth.com for relevant disclosures.

Active portfolio management, including market timing, can subject longer term investors to potentially higher fees and can have a negative effect on the long-term performance due to the transaction costs of the short-term trading. In addition, there may be potential tax consequences from these strategies. Active portfolio management and market timing may be unsuitable for some investors depending on their specific investment objectives and financial position. Active portfolio management does not guarantee a profit or protect against a loss in a declining market. Asset Allocation does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.